Profile

1291 The Swiss Investment Foundation was set up by Freienbach-based Butti Bauunternehmung AG, which has been active and successful in the property market since 1909. 1291 The Swiss Investment Foundation is advised by Nova Property Fund Management AG.

With the Occupational Pension Supervisory Commission (OAK BV) as its supervisory authority, the investment foundation is a member of the Conference of Managers of Investment Foundations (KGAST).

Foundation Board and Executive Management.

Focus & Strategy.

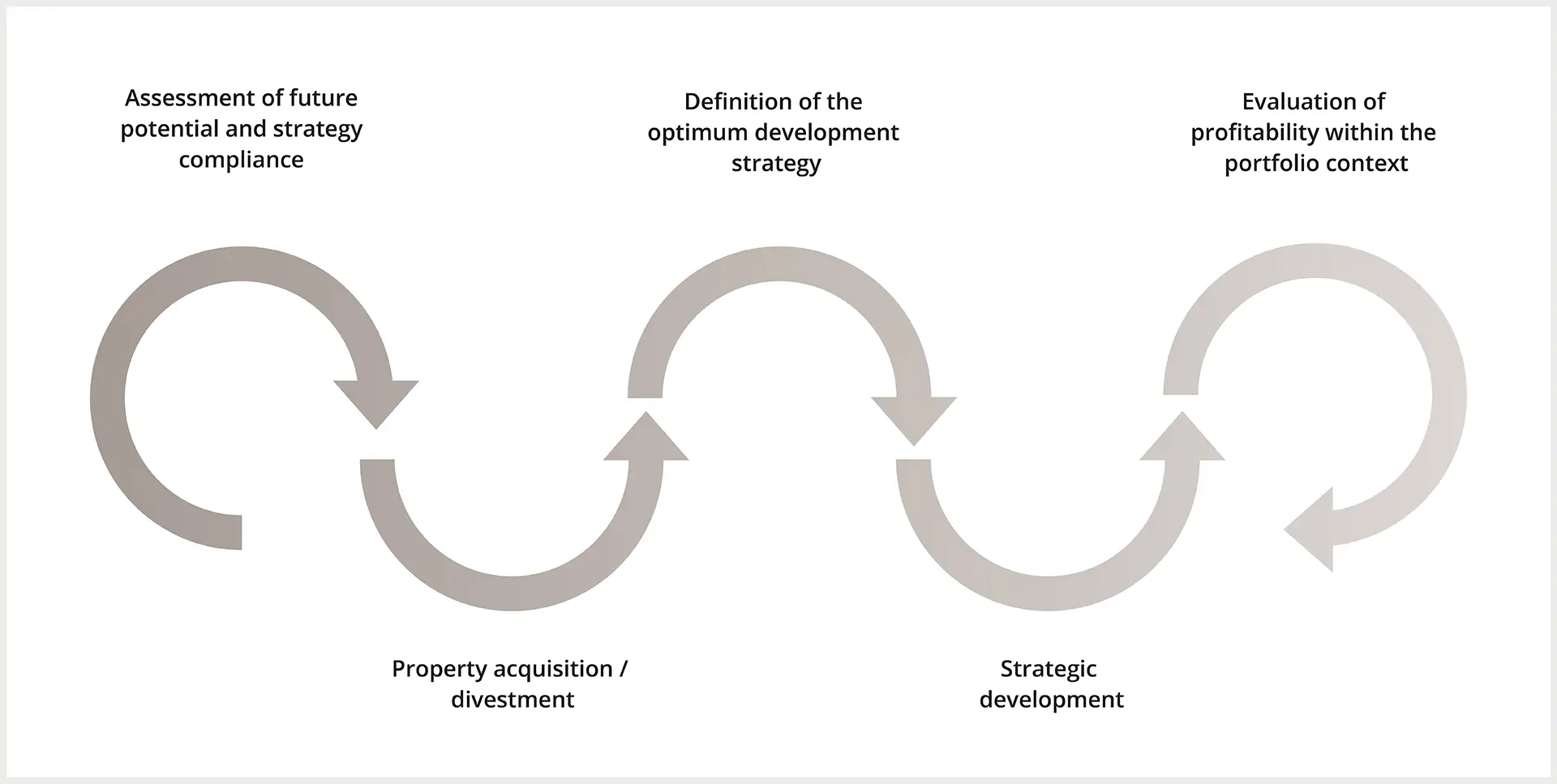

1291 The Swiss Investment Foundation invests in property across Switzerland. Acquisitions cover both residential and non-residential real estate like offices, retail units, commercial premises and logistics centers. The focus is on achieving the right balance of real estate in different locations and with different uses, with a focus on the residential sector. Sites are selected primarily on the basis of property market cycles, economic power and forecasts, politics and the legal/tax situation. Property location and quality are key factors for reletting, long-term profitability and opportunities to increase value. All properties in the portfolio shall meet key sustainability requirements and thus contribute to ESG in the long term.

The investment group Real Estate Switzerland invests in selected residential, office, service, retail and commercial properties across Switzerland. The investment focus is clearly on residential real estate, with a target quota of at least 60%.

In the investment group Sustainable Real Estate Projects Switzerland, the investment focus is on developing and expanding a diversified real estate portfolio made up of new construction projects and project developments with a residential share of at least 60% too.

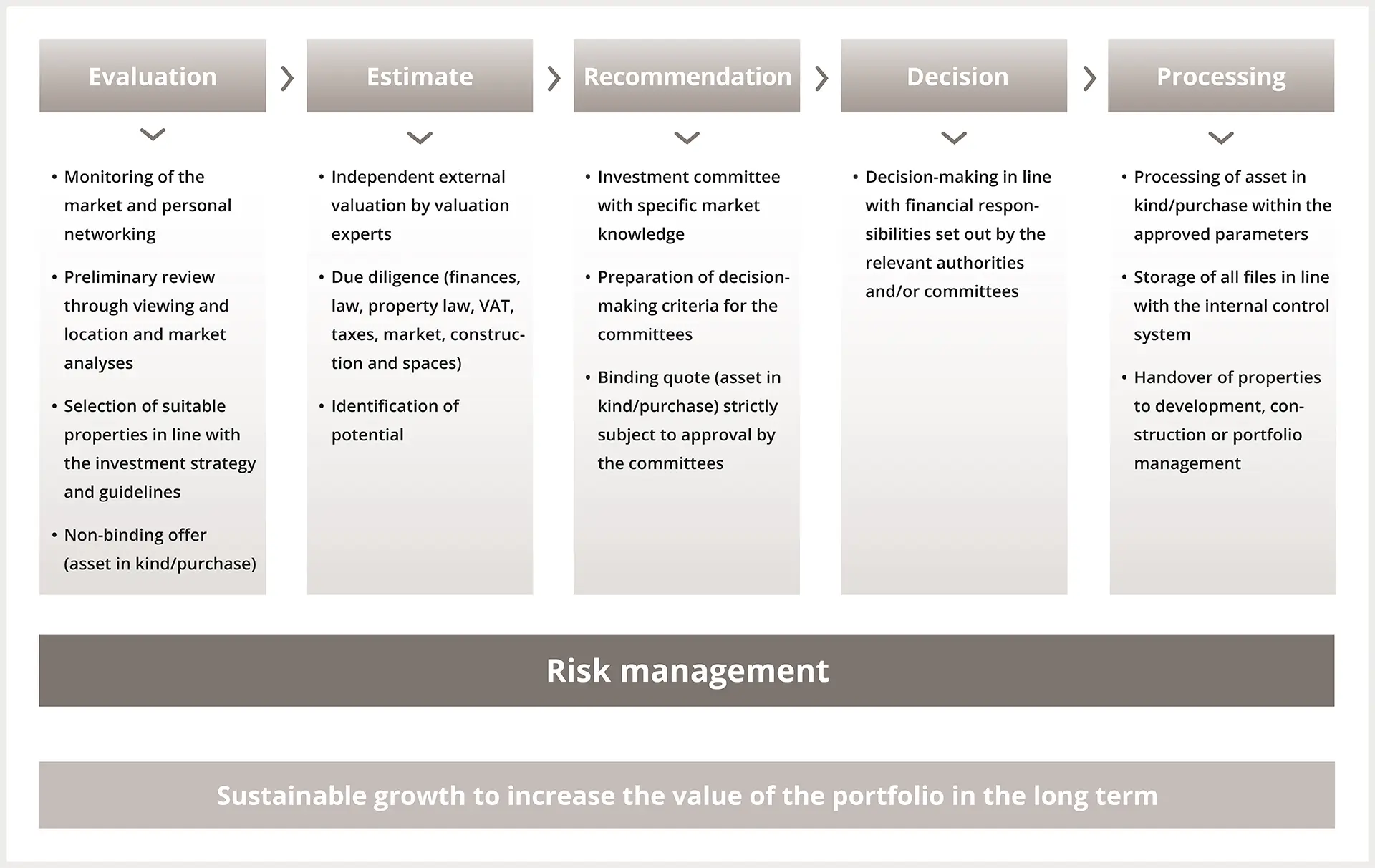

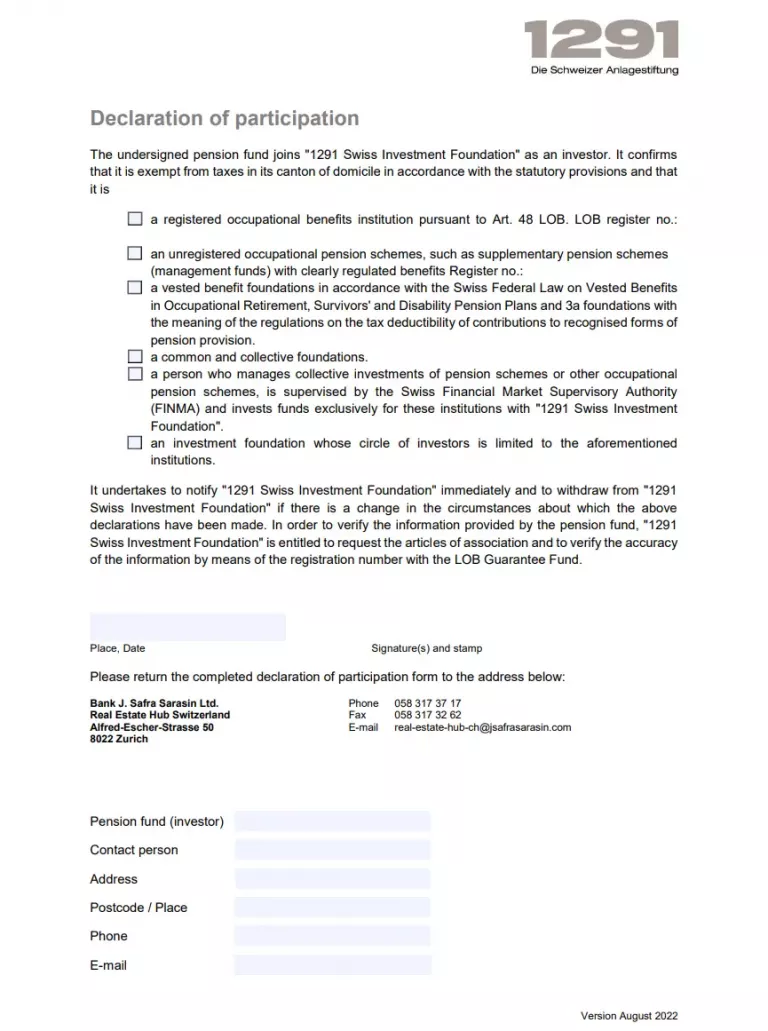

Contributions in kind

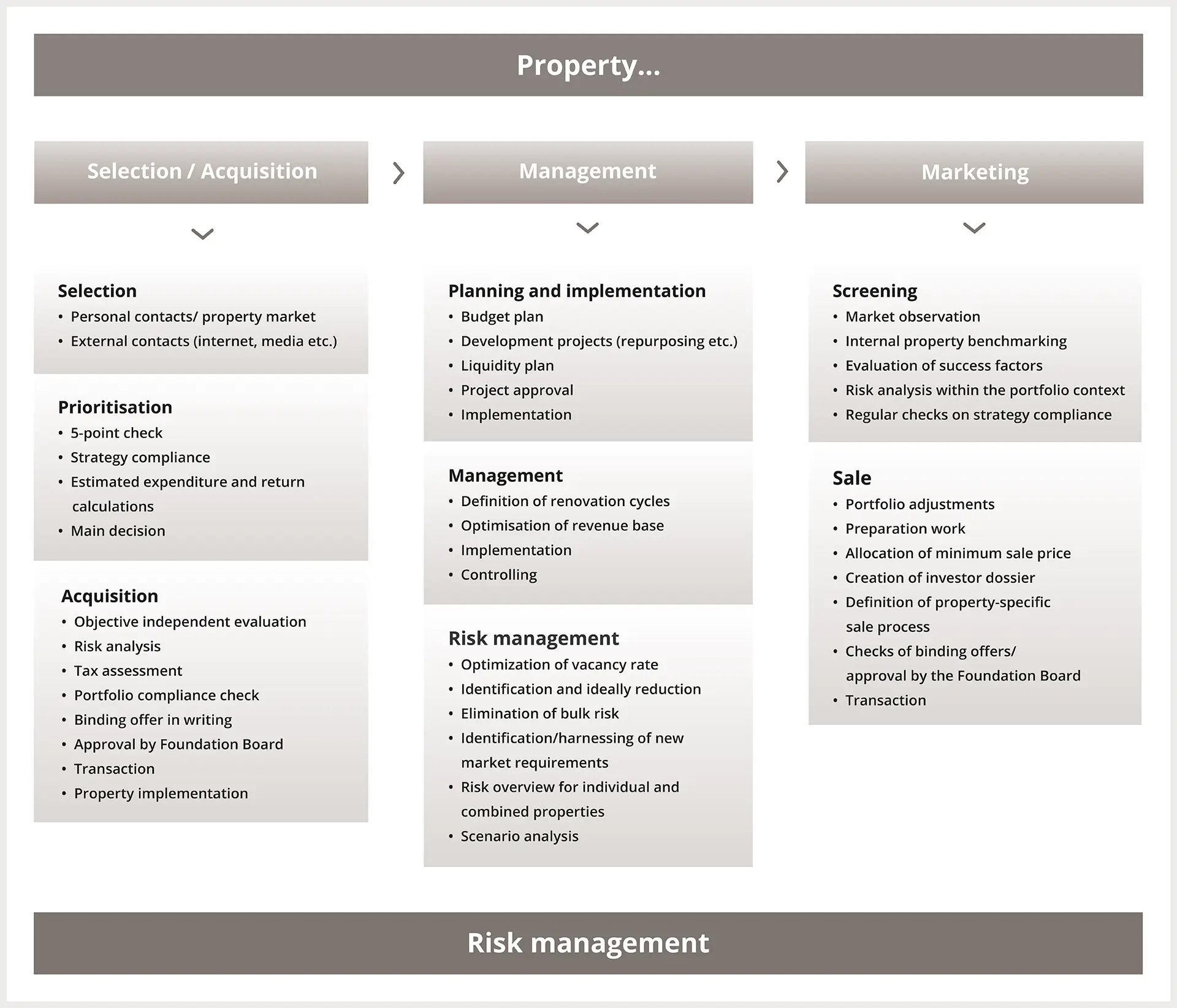

The secrets to property investment success.

1291 The Swiss Investment Foundation gives small and medium-sized pension schemes the opportunity to transfer the direct holdings in their real estate portfolio to the investment foundation through contributions in kind. They can thus profit from an increased diversification and professional portfolio management. The investment foundation’s close ties with developers also make it possible to seize opportunities to increase the value of properties (e.g. by repurposing them).

Download Center Investment Foundation